At Palmer-Donavin, our tagline is We Deliver More™ and this extends to our employee-owners by providing competitive benefits that meet personal and financial needs. Taking care of our employees is a top priority, and we show our appreciation through a variety of benefits for employees and their families. We are proud to offer an excellent benefits package with retirement funds you won’t find at a traditional company. Both full-time and part-time employees of Palmer-Donavin have the opportunity to enroll in a variety of benefit programs.

Select from three plans for the best fit for you and your family.

Our dental plan is designed to help you maintain a healthy smile through regular dental care and fix any problems as soon as they occur.

Keep your vision clear with regular eye exams.

Saving for retirement is easy with auto-enrollment and a company match.

Employees have the option to enroll in supplemental life insurance for themselves, their spouse, and their children.

Care Coordinators can help with billing and benefit questions, claims, ordering ID cards, finding in-network providers, and reducing out-of-pocket costs.

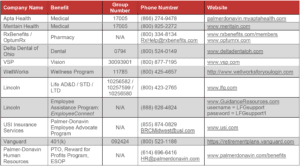

We are here to help. Contact us with questions or review our Frequently Asked Questions Guide.

View the holiday schedule we offer employees paid time off to be with their family.

A quarterly bonuses based on the profitability of the company. This is part of being in an ESOP.

This begins accruing immediately upon hire and increases at milestone service years.

An employee retirement plan where the company contributes shares of its own stock to an account for each employee.

You will receive discounts on all products we sell for personal use. This is great especially if you’re into DIY projects.

We understand the importance of being with your family during a time of loss and heartache.

Apta Care Coordinators are an expert team of nurses, patient services representatives and benefits specialists who are ready to help you before, during and after any health event. Think of Care Coordinators as your personal healthcare team. They fight hard to help you save money and make sure you get the best possible care for you and your family.

Care Coordinators can help with ordering ID cards, claims, billing and benefit questions, finding in-network providers, and reducing out-of-pocket costs. You can contact them at 866.274.9478, via this website, or through the myQHealth app.

As a Palmer-Donavin employee, you are eligible for benefits if you work at least 30 hours per week. Once your health benefit elections become effective, they remain in effect until December 31st of each year. You may only change coverage during the annual Open Enrollment or within 30 days of a qualified life event. Life and disability benefits roll from year to year.

If your spouse is employed and his/her employer offers health insurance coverage, Palmer-Donavin requires your spouse participate in his/her employer’s group health insurance plan. Your spouse is still eligible to participate in the dental and vision coverage even if his/her employer offers coverage.

Palmer-Donavin partners with Ameriflex to offer eligible employees the opportunity to participate in an FSA program. These programs work like a savings account; each pay period, a pre-tax payroll deduction is deposited to your Health Care and/or Dependent Care Account. When you need money to cover an eligible expense, you make a pre-tax “withdrawal” by using your Ameriflex MasterCard or completing a claim form and providing proper documentation. Funds must be used by December 31, 2022, but the General and Limited Purpose FSA will allow participants to carryover up to $550 of unused funds to the next year.

Our organization offers a qualified High Deductible Health Plan (HDHP) which allows employees enrolled in the HDHP to open a Health Savings Account (HSA) to help cover your health care expenses. The funds in your HSA can be used to help pay your deductible, coinsurance, and any qualified health care expenses. A “qualified” expense is an expense for medical care as defined by IRS Code Section 213(d), which includes prescription drugs, physician office visits, dental, and vision expenses.

Your total HSA contribution for 2022 cannot exceed $3,650 for an individual or $7,300 for employees with family HDHP coverage. If you are age 55 or older (and not enrolled in Medicare), you are eligible to make a $1,000 catch-up contribution. Please note HSA balances roll over year to year.